Risk Tolerance Questionnaires Should Be Banned

Using Risk tolerance questionnaires to develop a client’s investment strategy is a breach of fiduciary responsibility!

The client is ill-served by any advisor who requires their client to go through a lengthy financial planning process to determine what purpose the client is investing for and then uses a risk tolerance questionnaire to develop an investment strategy based on preferences.

How does an advisor know if their clients are on the right path to achieving their financial goals?

A risk tolerance questionnaire will certainly not tell them.

All a risk tolerance questionnaire will do is provide an assessment of the investor’s tolerance for volatility and volatility is not RISK!

Risk is not meeting some future cash flow need.

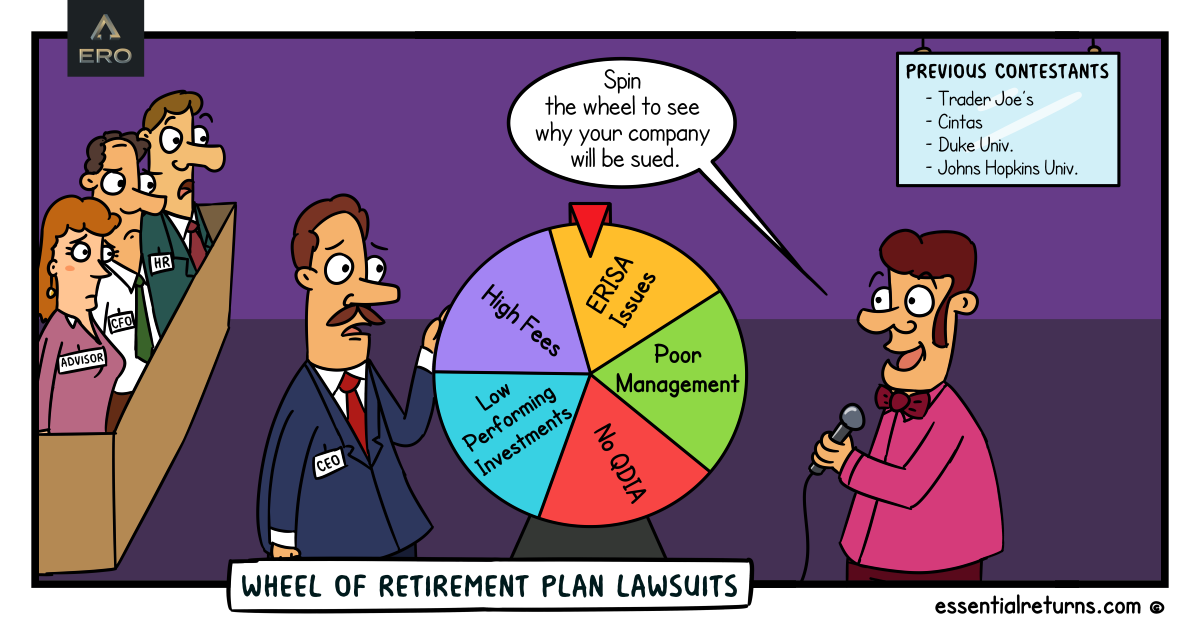

Countless companies are being sued because plan participants have little to no income to sustain them through retirement.

I know the industry has been grappling with the use of risk tolerance questionnaires because they have given us an even bigger disaster; Target-Date and Life Cycle Funds!

Does anyone seriously believe that a 401k participant that needs 70% of their current income at retirement is going to be well served by either of these disastrous products?

As we roar into the 20’s isn’t it time for the industry to be honest with investors?

Risk tolerance questionnaires will not inform the investor of the progress they are making toward achieving their financial goal and I don’t care how many TV commercials insinuate they will.

Using a one size fits all risk tolerance questionnaire that is based on a client’s preferences rather than needs and is applied to every financial goal the client may have, from saving for retirement to a child’s college education is a breach of fiduciary responsibility.

Does anyone logically believe that the same investment strategy for one’s retirement should be applied toward saving for a child’s education?

Or paying off a mortgage, healthcare needs or meeting monthly liabilities?

Of course NOT! If anyone believes that they should be banned from the industry.

However, there is a better intelligent way.

What if there was a new calculator that not only could assess whether the clients were on the right path to achieving their financial goals but could also suggest altering the investment strategy necessary to reach those goals.

What if this calculator could systematically suggest when to “buy low or sell high”?

Unlike current financial calculators that assume a rate of return that never changes, what if this new calculator (unlike the static risk tolerance questionnaire calculations) is dynamic, taking into account the many factors that could impact the assets in a client’s account?

From market conditions to the client’s personal financial situation, what if this new calculator could immediately identify opportunities or concerns that can impact your client’s financial wellbeing?

Well that calculator exists and it is a key element of the new approach to building better portfolios based on needs not subjective emotions about volatility.

We refer to this new approach as Essential Returns Objectives or ERO

Below is an example of a 30-year old individual saving for retirement in the hopes of replacing 70% of their current income.

The individual currently earns a $65,000 annual income, has $5,000 in assets, can contribute $500/month and is looking to retire at 65.

To succeed in replacing 70% of income at retirement, this is individual needs to be an investment strategy generating at minimum a 9% return.

Now let’s assume the client’s financial situation has changed over the year.

For example, annual income is now $75,000, current assets have grown to $15,000 and monthly contributions have increased to $1,000.

The return now needed to replace 70% of current income at retirement has gone from 9% to 6.6%.

The investment strategy now needs less exposure to equities that it did in the prior year.

After a year where we just experienced double-digit returns doesn’t it make sense to reduce equity exposure?

Of course, the situation could have been reversed with the market experiencing a double-digit decline suggesting that the client’s equity exposure should be increased.

In either case, the client will be aware of the path they are on to achieve their financial goal.

More importantly, in this case, both financial advisors and plan sponsors are making sure that the investor knows the progress they are making toward their financial goal, reducing the uncertainty and the emotional stress that comes with creating financial security.

I am well aware that risk tolerance questionnaires are considered a requirement.

At best, use the questionnaire as an emotional barometer.

However, investment strategies must be based on logic, facts, and data to ensure investors achieve their goals, not emotions that swing with the market.

As the above example clearly indicates, in either an appreciating or depreciating market the response to a risk tolerance questionnaire is useless for today’s portfolio navigation realities.

As a fiduciary, isn’t it time to think differently?

As a plan sponsor, isn’t it time to protect your company against the growing retirement plan lawsuits?

Talk To Us